Overview of ITU work on tariff and accounting matters, international mobile roaming,

advertisement

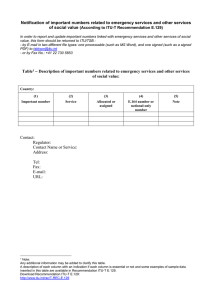

Overview of ITU work on tariff and accounting matters, international mobile roaming, international Internet connectivity, and taxation issues APT-ITU workshop on the International Telecommunications Regulations Bangkok, 6-8 February 2012 Richard Hill, ITU Presentation Outline 1. 2. 3. 4. Tariff and accounting matters International mobile roaming International Internet connectivity Taxation of ICT/Telecommunication services 1) Tariff and accounting matters Background: • • • • • • In 1885, an article consisting of five general paragraphs devoted to the “international telephone service” was added to the Telegraph Regulations. In 1932, the Telegraph Convention of 1875 and the Radiotelegraph Convention of 1927 were combined into a single convention embracing the three fields of telegraphy, telephony and radio. The 1932 and 1938 Telephone Regulations did not apply to all countries, but only to European countries and countries that voluntarily chose to join the “European system”. The actual tariffs agreed between countries were not included in the treaty, they were published elsewhere. In 1973 the Telegraph Regulations and the Telephone Regulations were last revised and drastically simplified focusing on general principles, more detailed operational provisions were moved to Recommendations. Throughout all these developments, the basic principles dealing with tariffs remained unchanged, including the rate for a communication between two countries. The Telegraph Regulations and Telephone Regulations were superseded in 1988 by the International Telecommunications Regulations (ITRs). The 1988 International Telecommunications Regulations (ITRs) Background: • The ITRs contained a key provision in Article 9, Special Arrangements. • It was only in 1988 that, private operators were explicitly allowed to use leased lines to provide services, including data services. Facilitating the expansion of networks (TCP/IP protocol) and the Internet services. • Although tariffs were supposed to be based on costs, in practice they often were not: high prices for international connections were used to subsidize national services. • The privatization and liberalization of telecommunications markets were facilitated by the Global Agreement on Trade in Services (GATS) in 1994 and in 1996 (Reference Paper on Basic Telecommunications Services). Provisions included requirements related to interconnection Tariffs: to be cost-oriented, transparent, and reasonable Main difference between the traditional accounting rate system and the new regime Traditional system New regime Accounting rates International interconnection rates Normally symmetric (accounting rate split 50/50) Asymmetric (charges may vary between countries) Bilaterally negotiated Set unilaterally, but subject to trade discipline Discriminatory (different rates with different correspondents) Non-discriminatory (same reference interconnect offer offered to all carriers) Half-circuit regime (not normally unbundled) Full-circuit regime (can be unbundled) A new regime for international interconnection has become prevalent since the mid 1990s. The main differences between the traditional accounting rate system and the new regime is summarized in this table. Average cost of one minute of fixed telephony The changes in national regulatory practices resulting from the general trends towards liberalization and privatization resulted in very significant decreases in the cost of international telecommunications. ITU work on tariff and accounting matters (1) • • In order to adapt the remuneration system to the new, more competitive telecommunication environment, and to respond to the growing expectations of the international community, Study Group 3 started an overall review of the remuneration system as from 1991. The topic has generated considerable interest and, delegates representing more than 80 countries exchanged opinions and participated actively in the meetings. The following represent common objectives for the work: – to develop general principles and guidelines for the establishment of accounting rates; – to determine cost components to be included in the telephone accounting rates; – to expedite work on developing appropriate costing methodologies; – to establish a transition period to avoid drastic changes, particularly for the developing countries. ITU work on tariff and accounting matters (2) • Study Group 3 developed ITU-T Recommendation D.140 on accounting rates principles for the international telephone service. Five principles were adopted: – cost-orientation of accounting rates and accounting rate shares; – application of the cost-orientation principles to all relations on a nondiscriminatory basis; – implementation on a scheduled basis of one to five years, if a transitional timeframe is necessary; – periodical review of accounting rates by NRAs; – to survey and publish global accounting rates movement yearly. ITU work on tariff and accounting matters (3) • Study Group 3 continued its work on reform of the accounting rate system to reflect the new telecommunication environment. • In December 1998, Study Group 3 approved a revision to ITU-T Recommendation D.150. • It agreed on three new procedures for remunerating the party that terminates international traffic: Termination charge procedure allows governments or operators to establish a single charge for terminating traffic in their country Settlement rate procedure allows them to negotiate cost-orientated and asymmetric settlement rates Commercial arrangement between countries that have introduced liberalization, allows any other bilaterally negotiated commercial arrangement ITU work on tariff and accounting matters (4) • Study Group 3 also developed guidelines on transitional arrangements, as a new draft Annex to Recommendation D.140. • The regional Tariff Groups made a number of useful cost studies related to the provision of international telephone services. • During 2001, the ITU-D sector developed a cost model (COSITU)that takes in to consideration the above mentioned ITU-T Recommendations and methodologies. • ITU-D, activities in this area largely focused on assisting Members to determine the cost of regulated services in light of changing market and technological developments through out workshops, training and direct assistance. BDT and TSB continue working together to study the evolution of tariffs and accounting matters in the changing market and technological developments Proposals made to CWG-WCIT by the membership on Tariff and accounting matters • Leave the substance of the current ITRs unchanged: the provisions are still valid and useful. • Revise the current provisions to adapt them to the current telecommunications environment, which is very different from that of 1988: in particular, consider provisions that would give greater weight to ITU-T Recommendations and that would shorten the deadlines currently found in the ITRs. • Replace the current provisions (which are quite detailed) with general principles related to the principles agreed in WTO, in particular introduce principles related to transparency and costorientation. • Abrogate (delete) the current provisions: they are no longer appropriate or applicable in the current privatized and liberalized telecommunications environment. 2) International mobile roaming ITU work focused on: • Identify related work and to collect data (various reports developed by BDT and other organizations), • Launch of a questionnaire to ITU members to collect information. On the basis of those reports, contributions from the membership, and discussions, many members take the view that: – rates are too high with respect to costs, – competition does not seem to be driving down the prices charged for international mobile roaming, – uncoordinated national measures are not likely to be effective, and – regional or international solutions should be envisaged. The text of a draft ITU-T Recommendation on International Mobile Roaming has been agreed by Study Group 3 and will be proposed for formal approval in September 2012 Proposals made to CWG-WCIT by the membership on international roaming rates • Ensure transparency of end-user prices • Ensure that rates are cost-based 3) International Internet connectivity (IIC) Work done by ITU: • After WTSA-2000, Study Group 3 decided to conduct further study on the technical and economic development related to IIC. • Study Group 3 decided to establish two Rapporteur Groups: – The first Rapporteur Group on IIC is in charge of developing further guidelines for facilitating the implementation of Recommendation D.50, – The second Rapporteur Group is in charge of examining the possibility of using traffic flow as a main factor of negotiation for IIC. • Based on the proposals from those Rapporteur Groups, Study Group 3 adopted a guideline which complements Recommendation D.50. • Study Group 3 also agreed the following problem: – The high costs of the international circuit for Internet connectivity between least developed countries and the Internet backbone networks, – The development and use of the Internet in many developing and in particular in the LDCs, – The lack of resources for using and producing local content. 3) International Internet connectivity (IIC) • Revisions to Recommendation D.50 were approved in October 2008 and April 2011. • There was considerable work in SG3 after 2008 regarding the use of measurement of IP traffic flows in connection with billing for International Internet connections. • The matter was explored in some detail at a workshop on 24 March 2011 and in April 2011 a Supplement to Recommendation D.50 was adopted. • In coordination with ITU-D, a study on International Internet Connectivity is being developed to discuss international and national interconnection. Results from this study had been presented and discussed in the ITU Workshop on Apportionment of Revenues and International Internet Connectivity (Geneva on 23-24 January 2012) Results from the ITU Workshop on International Internet Connectivity During the discussions, several measures were noted which might facilitate increased internet connectivity, in particular (in no particular order): • Increasing competition, in particular for international connectivity • Generate an environment that encourages the investment and the implementation of innovative technical solutions and services • Implementation of Internet Exchange Points (IXPs) at the national and regional level • Implementation of national and regional cacheing for frequently accessed content • Increase usage of national ccTLDs and national hosting of web sites • Increasing provision of national and regional content • Policies and programs to stimulate demand and increase usage of Internet • Implementation of network nodes on the basis of observed traffic flows (this may require additional efforts to measure traffic flows) • Transit infrastructure – ownership and management model - development of business plan • Coordination and participation of all the players (Government , ISP and Operators) • Infrastructure sharing • Sharing of the cost of International Internet Connectivity, for example based on traffic measurements, or on the basis of network externalities. Summary report ITU Workshop on Apportionment of Revenues and International Internet Connectivity www.itu.int/ITU-T/worksem/apportionment/201201/index.html Proposals made to CWG-WCIT by the membership on IIC No specific proposals have been made by the membership to CWGWCIT but many proposals have been made in various other forums, including ITU workshops and ITU study groups, for example: • Encourage the development of competitive regimes at the national level for international internet connectivity (as opposed to monopoly regimes for international gateways). • Encourage implementation of Internet Exchange Points (IXPs) at the national and regional levels. • Encourage the development of high capacity regional and interregional backbones, in particular via submarine cables. • Measure IP traffic flows and use the results in connection with billing. 4) Taxation • • • The issue of taxation of international telecommunications is covered in the current version of the ITRs, in article 6.1.3. CWG-WCIT/INF-3 presents the results from the ITU workshop held in 2011 on taxation of telecommunications services and related products. The situation of double taxation needs to be considered as a priority by Administrations, in order to mitigate its potential consequences and ensure that tax rules are applied consistently and fairly, a mechanism for avoiding double taxation should: – protect against the risk of double taxation in instances where the same income is taxable in two countries; – define which taxes are covered by the agreement; – provide a procedural framework for enforcement and dispute resolution; – protect each government's taxing rights; and – protect against attempts to avoid or evade tax liability. Proposals made to CWG-WCIT by the membership on Taxation • Leave the current text unchanged. • Revise the current text to clarify that it is intended to prevent economic double taxation. • Revise the current text to limit certain types of taxation, in particular so as to avoid specific taxes on incoming international traffic. • Suppress the current text.