managerialfinaltheory

advertisement

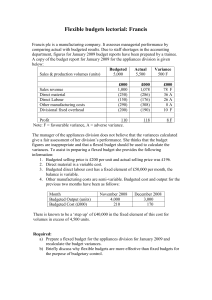

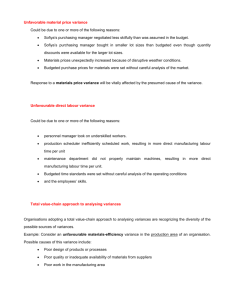

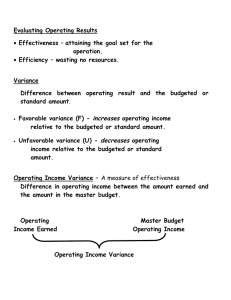

Average rate of return and cash payback are very simplistic In the short term payback allows managers to foresee the effects of cash flow; however this becomes more difficult as they look further ahead. It is difficult to compare two project with different life spans Often more than one method might be used Consideration might also be given to the cost of leasing non-current assets Exchange rates and inflation might have a greater or lesser effect than predicted. Qualitative issues such as product quality, flexibility, productivity, market changes and staff morale might also change Budgetary control process Prepare budgets Perform and collect information on actual performance Identify variances between planned (budgeted) and actual performance Respond to variances between planned and actual performance and exercise control Behavioural issues of budgetary control Budgets can improve job satisfaction and performance Demanding, yet achievable, budget targets can motivate more than less demanding ones Unrealistically demanding targets can adversely effect managers’ performance Participation of managers in setting their targets can improve motivation and performance Problems with applying standard costing techniques Standards can quickly become outdated Factors beyond the control of the manager may affect a variance Difficult to demarcate management responsibilities No incentive to achieve beyond the standard Standards may create perverse incentives Adverse variance: where an expense item is greater than budgeted or where an income item is less than budgeted. Favourable variance: where an expense item is less than budgeted or where an income item is more than budgeted. As technology progresses: manufacturing becomes more automated, reliability increase, the life cycle of production equipment falls, as does efficiency. Management have to consider whether to keep producing using older machines or to update t more modern equipment Limitations The decision might be based on predictions, and they can only ever be estimates The decisions need to be made on accurate information and be realistic. The manager will never know if they made the right decision, as there is no well of telling what might have happened if the alternative was chosen! Managerial accounting can be used to help decision making in a variety of scenarios, outlined in this paper. But management must also remember to consider other actors such as brand awareness, market share, reaction of staff to changes. Price Issues: There are two main market methods to consider Demand-based: sets price according to demand, high demand = high price, low demand = low price. Competition-based: Stes the price according to the market and competition There are also cost plus methods of costing Product cost: Manufacturing cost + a mark up to cover admin, selling and desired profit. Total cost, manufacturing plus selling and admin are the basis, and a percentage added. Variable cost concept: Only variable (manufacturing, admin and selling) costs are included, and a mark-up added.