International Strategy -- 2006 - Global Business Alliance of New

advertisement

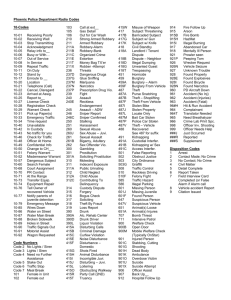

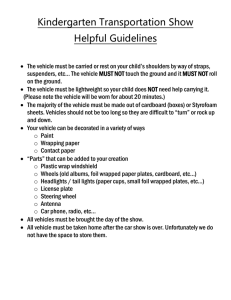

Doing Business in Emerging International Markets Global Business Alliance 13th Annual Business Forum Presented by M. Sean Molloy Regional Director, Asia Pacific DATE 02-07-07 Agenda Introduction LoJack Corporate Overview – Defining the challenge: Vehicle theft – Company Information – LoJack Products and Services LoJack International – Mitigating risk through Licensee relationships – Key international initiatives Emerging Market Opportunities – China – India Global Economic Challenges – Risk of no presence may be greater than operational risk – Risk mitigation; leveraging community resources 2 Conclusions Vehicle Theft Problem Vehicle Theft North America – A vehicle is stolen every 25 seconds – 1.2M vehicles stolen per year – $20B per year Europe – 1.5M vehicles stolen per year (Europol) – $22B per year – Countries with highest rate of stolen vehicles – UK, France, Italy, Spain, Poland (Europol) Asia Pacific – Est. 600,000 vehicles stolen per year (approx. $10B per year) – High theft rates and ratio of NVS to car parc in India & China – Growing theft with income disparity in emerging markets 4 LoJack – Corporate Overview Mission – To Be the Leading Global Provider of Products and Services for the Tracking and Recovery of Valuable Mobile Assets 6 LoJack Corporation (LOJN) World leader in stolen vehicle tracking and recovery 90+% recovery rate 20-year history of success NASDAQ-listed company ― Symbol: LOJN Global ― 26 States + Washington D.C. ― 28 Countries 7 Over 5 million units sold and installed • Over 180,000 vehicles recovered globally worth $3 billion Core Strengths • Proprietary covert Radio Frequency Technology • Extensive Private Wireless Network • Relationships with Law Enforcement • Compelling Commercial Model • Insurance Relationships • Brand Recognition (see below) 97% 96% 94% 93.3% 93% 93% 91% 85% 77% Duracell Wal-Mart U.S. survey - aided & unaided 8 Kleenex Yahoo AT&T MasterCard ebay Amazon.com Markets Served Passenger Cars Motorcycles Mobile Assets Commercial Vehicles Construction Equipment 9 Cargo Strong Revenue Growth $200 $ in millions CAGR (2001-2005) = 17.5% $180 $160 $140 $120 $100 $80 $60 2001 10 2002 2003 2004 2005 3 years of consistent quarter over quarter growth in revenue and earnings Revenue: 70% US – 30% International Units Sold: 50% US – 50% International Business Segments Domestic – Automotive Dealers – Construction – Motorcycle YTD 2006 Boomerang – Insurance – Automotive Dealers Consolidate Revenue International – Licensees – Limited Investment 9% 21% 70% Boomerang Domestic International Segment 11 LoJack Recovery Network Coverage Areas LoJack works best in areas with: – Greatest population density – Highest number of new vehicle sales – Highest incidence of vehicle theft Arizona California Colorado Connecticut Delaware District of Columbia Florida Georgia Illinois Louisiana Maryland Massachusetts Michigan Nevada New Hampshire New Jersey New York LoJack operates in markets that represent 70% of theft in the nation 12 North Carolina Ohio Oregon Pennsylvania Rhode Island South Carolina Tennessee Texas Virginia Washington LoJack’s Global Footprint CANADA UNITED KINGDOM GERMANY RUSSIA POLAND BELGIUM FRANCE SPAIN PORTUGAL UNITED STATES ITALY MEXICO CHINA BELIZE GUATEMALA EL SALVADOR COSTA RICA PANAMA HONDURAS NICARAGUA COLUMBIA DOMINICAN REPUBLIC PUERTO RICO TRINIDAD & TOBAGO CAMEROON VENEZUELA HONG KONG UGANDA KENYA ECUADOR MOZAMBIQUE BRAZIL PERU PARAGUAY ARGENTINA SWAZILAND LESOTHO SOUTH AFRICA URUGUAY LEGEND LEGEND Licensed Countries Countries with LoJack SVR Operations 13 LoJack Brands 14 Products and Services How LoJack Works 16 The LoJack system includes a small wireless transceiver that is randomly hidden in your customer’s vehicle When activated, the unit emits silent radio signals over the LoJack network that allow the police to track and recover the vehicle (complemented by Early Warning product) 1 2 3 4 5 Installation Notification Activation Location Recovery • LoJack unit hidden in vehicle by certified technician. • Registered in LoJack or police database. • Customer reports theft to police or directly to LoJack in certain regions. • Police or LoJack send radio signal from tower. • LoJack unit emits uniquely coded signal. • The signal is tracked and used to locate the vehicle, usually within hours. • The vehicle is returned to the owner. Market Drivers Best Technology Choice - Proven – Technology more robust than competitive technologies Dealership Benefits – Dealers make money on sale and installation – Customer satisfaction Insurance – Many global markets are driven by insurance mandates • Europe, Latin America, South Africa – Insurance discounts are offered in many regions Customers – Provides asset protection and peace of mind – Proven product with real consumer benefit 17 LoJack International Building a Global Brand LoJack’s International Expansion 1992 expansion begins Builds on Bill Reagan’s entrepreneurial origins Early technology license & distribution model – – – – – – – Growing need to hedge against regional/global risks – – – – 19 Licensing fees finance expansion Seeking local experts allows for immediate market entry Allows for local tracking and marketing flexibility Leverages entrepreneurial innovation and R & D Minimizes investment requirements Allows for local relationship management Cuts down on international administration costs Need to leverage brand value globally (Global SVR leader) “on call” and black box safety regulations Demand for regional operational coverage Telematics IT convergence and OEM relationships Evolving model for emerging markets Increasing International Market Penetration Market Opportunity – 66 Million New Vehicles Sold Annually – For Every Vehicle Stolen in U.S., 2 are Stolen Globally Licensee Strategies for Growth – Develop Programs Enabling Licensees to Increase Local Market Share – Consolidating operations and establishing subsidiary presence – New product development – Develop New Markets in Asia/Pacific Rim – Seek Global Agreements with Vehicle Manufacturers 20 Leveraging Global Presence Ownership and Operation of Select Markets – Creating Shareholder Value Italy First Step – Operational in Rome and Milan Pan-European Network – Distribution and Recovery Experience in U.S. Applicable Develop key emerging markets – China ’07 – India & SE Asia in development 21 Developing New Products in the Tracking and Recovery Space 22 Knowledge of Police Systems and Process Proven Radio Frequency (RF) Technology Brand = Tracking and Recovery SVR in Emerging Markets Considering China and India Emerging Market Opportunities China and India – – – – the two most populous countries, account for 40% of the world’s population, are the fastest growing economies in the world Business objectives moving from outsourcing and supply chain efficiencies to presence & market share Challenges remain: developing economies in transition – Formation of institutions (political and regulatory) – Formation and maturity of markets Impacts becoming material – Impacts of continued Sino-Indian growth will become larger – In 1980 when China grew ten percent, the absolute increment to global GDP and global demand was insignificant. – Now the GDP is over 1.88 trillion $, and a ten percent increment is large in absolute terms (equivalent in terms of global demand of about a 1.4% increment in US growth 24 Engines for Global Growth China and India represent unprecedented growth opportunities GDP per capita predicted to grow by a factor of 4 to 7 within next 20 years Obvious impacts on global consumer spending trends GDP per capita: China and India (constant 2000 US$) 1600 8000 1400 7000 2025 2004 2002 2000 1998 1996 1994 1992 0 1990 0 1988 1000 1986 200 1984 2000 1982 400 1980 China GDP per capita (constant 2000 US$) 3000 2020 600 4000 2000 China GDP per capita (constant 2000 US$) 5000 1995 800 India GDP per capita (constant 2000 US$) 1990 1000 6000 1985 India GDP per capita (constant 2000 US$) 1980 1200 25 Future Growth 2015 2010 2005 China and India: The Fastest Growing Vehicle Markets in the World • China’s 2004 car parc was 24.1 Million • China’s car parc grew at CAGR of 5% from 2000 - 2004 • China’s car parc is predicted to grow at CAGR of 9% from 2005 - 2015 • China already is the third largest light vehicle market by vehicle sales in the world • China is expected to become the second largest auto market in 2007, surpassing Japan • India projected to grow to 3M in annual new vehicles sold by 2010 HISTORICAL AND PROJECTED CHINA CAR PARC — LIGHT VEHICLES 80.0 69.8 Car Parc (in millions) 70.0 60.0 49.0 50.0 44.9 40.6 36.1 40.0 30.0 20.0 12.3 13.7 15.3 11.1 1998 1999 2000 2001 17.5 20.7 24.1 27.8 31.8 10.0 0.0 2002 2003 2004 2005E 2006E 2007E 2008E 2009E 2010E 2015E Source : Global Insight Asian Automotive Industry Forecast Report August 2005. Light vehicles include passenger cars and light trucks. China and India: Vehicle Theft Rates Among the Highest Worldwide • “Automobile theft is rampant. In 2005, Chinese police authorities recorded 683,000 automobile theft cases” Source: People’s Daily Online January 20, 2006 • Over 2% of the vehicle car parc was stolen in 2005 • Theft rates among the highest in the world, comparable with South Africa and Brazil • Market survey revealed that 50%+ of car owners know someone whose car was stolen • Theft rates in India skyrocketing, now also approaching 2% Estimated Global Theft Rates and 2004 Car Parc by Market Source : Global Insight Asian Automotive Industry Forecast Report August 2005, Company and LoJack Corporation estimates Global Economic Challenges “The World is Flat” Globalization as an opportunity and a challenge – Opportunities will become threats if not engaged – Avoiding emerging markets may be a bigger risk than confronting the challenges they present LoJack’s Approach – Leverage maximum resources through partnership – Maintain a focused, prioritized, and strategic approach to new markets and product development – Ensure leading position and brand recognition in developed countries and commit to key emerging markets – Identify and invest in good people 29 Utilizing Community Resources 30 Market studies Strategy consulting Partner search Regional networking Sharing best practices Regional consultants References Conclusions Globalization as an agent of change – The best companies will risk failure in order to gain opportunity – Risk is not a matter of choice, but strategy – Partnerships allow companies to overcome risk by leveraging shared resources and specialization – Harnessing entrepreneurship drives creativity and innovation in an increasingly competitive environment – A company is only as good as the people it keeps. 31