Solution

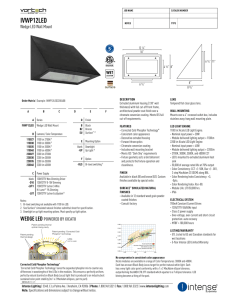

advertisement

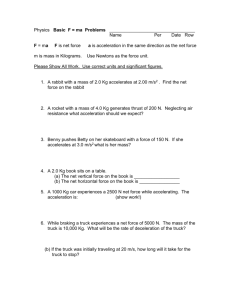

The Islamic University of Gaza Industrial Engineering department Engineering Economy, EIND 4303 Instructor: Dr. Mohammad Abuhaiba, P.E. Fall 2011 Exam date: 16/11/2011 MidTerm Exam (Open Book) Question Exam Duration: 1.5 hours Grade Maximum Grade 1 15 2 6 3 7 4 8 5 13 6 9 7 8 8 8 Total 74 1 Question #1: (15 points) A company has determined that the price and the monthly demand of one of its products are related by the equation 𝐷 = √500 − 𝑝 Where p is the price per unit in dollars and D is the monthly demand. The associated fixed costs are $1100/month, and the variable costs are $100/unit. a. What is the optimal number of units that should be produced and sold each month? b. What are the values of D at which the company break even? Solution: a) D = √500 − 𝑃 (1) 𝐷2 = 500 − 𝑃 (1) P = 500 – D2 (1) 𝑅 = 𝑃𝐷 = 𝐷 (500 − 𝐷2 ) = 500 𝐷 − 𝐷3 (2) 𝐶𝑇 = 1100 + 100 𝐷 (2) 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑃 = 𝑅 − 𝐶𝑇 = 500 𝐷 − 𝐷3 − 1100 − 100 𝐷 = 400 D – 𝐷3 − 1100 (2) 𝑑𝑃 = 0 = 400 − 3 𝐷2 (2) 𝑑𝐷 400 𝐷2 = 𝐷 ≅ 12 𝑢𝑛𝑖𝑡𝑠 (1) 3 b) Company breakeven when P = 0 = 400 – 400 𝐷3 − 1100 (1) Solve for D: D1 = 3 units (1) D2 = 18 units (1) 2 Question #2: (6 points) The future cost of a machine will be $250,000 in 10 years at an APR of 7% compounded annually. What is the present cost? Solution: F = $ 250,000 (1) , N = 10 years (1) , i= 7% (1) P=? P = F(1+i)-n = 25000 x 1.07 -10 = $12,709 Question #3: (7 points) What is the present worth of a series of 12 monthly payments at $300 with an 9% APR compounded monthly? Solution: A = $300 i= 9 12 = 0.75 (1) , N = 12 (1) , r = 9% (1), (1) p=? P = 300 (P/A, 0.75, 12) (2) = 300 x 11.4349 = $ 3430 (1) 3 Question #4: (8 points) Calculate the future equivalent at the end of 2011, at 8% per year, of the following series of cash flows in the figure below. Use a uniform gradient amount G in your solution. 2008 2009 2011 2010 $700 $800 $900 $1000 F=? Solution: (cash flows each 1 mark ) 0 1 2 3 4 800 5 700 900 1000 300 300 200 100 F 0 1 2 3 4 5 0 1 2 3 4 5 1000 F = - 1000 (F/A, 8%, 4) ( F/P,8%,1) + 100(F/G,8%,4)(F/P,8%,1) (4) = - 1000 x 4.5061 x 1.08 + 100 x 6.3264 x 1.08 = - $4183 (1) 4 Question #5: (13 points) Determine the present equivalent value of the cash flow diagram of the figure below when the annual interest rate, ik, varies as indicated. P=? $200 $200 $100 i = 6% 0 $100 i = 6% i = 8% i = 4% 3 2 1 i = 8% i = 4% 5 4 6 Solution: P = 200(P/F,6%,1) + 100(P/F,8%,1)(P/F,6%,1) + 200(P/F,4%,1)(P/F,6%,1)(P/F,8%,1)(P/F,6%,1) + 100(P/F,8%,1)(p/f,4%,2)(p/f,6%,1)(P/F,8%,1)(P/F,6%,1) = 200 1.06 + 100 1.08 𝑋 1.06 + 200 2 1.04 𝑋 1.06 𝑋 1.08 + 100 1.082 𝑋 1.04 2 𝑋 1.062 = $505 5 Question #6: (9 points) A small company heats its building and spends $8000 per year on natural gas for this purpose. Cost increases of natural gas expected to be 10% per year starting one year from now (i.e. the first cash flow is $8000 at EOY one). Their maintenance on the gas furnace is $400 per year, and this expense is expected to increase by 10% per year starting one year from now. If the planning horizon is 10 years, what is the total annual equivalent expense for operating and maintaining the furnace? The interest rate is 18% per year. Solution: f=10% (1) , i=18% (1) The cash flow (1 mark) P = 8400 [1- (P/F,18%, 10)(F/P,10%,10)] (each term with 1 mark) =105,000[1- 1.18 -10 x 1.1 10] = 52, 9656 (1) A = 52965 (A/P,18%,10) (1) = 52965 x 0.22254 = $ 11,785 (1) 6 Question #7: (8 points) An office supply company has purchased a light duty delivery truck for $20,000. It is anticipated that the purchase of the truck will increase the company’s revenue by $10,000 annually, while the associated operating expenses are expected to be $2000 per year. The truck’s market value is expected to decrease by $3000 each year it is in service. If the company plans to keep the truck for only two years, what is the annual worth of this investment? The MARR = 15% per year. Solution: Cash flow (2 marks) MARR = 15% A = - 20(A/P,15%,2) + 8 + 14(A/F,15%,2) = - 20 x 0.6151 + 8 + 14 x 0.4651 (3) (2) = $2,209 (1) 7 Question #8: (8 points) A computer call center is going to replace all of its incandescent lamps with more energy efficient fluorescent lighting fixtures. The total energy savings are estimated to be $2000 per year, and the cost of purchasing and installing the fluorescent fixtures is $5000. The study period is six years, and terminal market values for the fixtures are negligible. a. What is the IRR of this investment? b. What is the simple payback period of the investment? Solution: a) Cash flow (1 mark) PW = -5000 + 2000(P/A,i%,6) (P/A,i%,6) = 2.5 (2) (1) (i) 30 ? 35 The interpolation (2 marks) (2.5−2.6427) P/A 2.6427 2.5 2.3852 I= 30+5 x (2.3852−2.6427) = 32.77% Simple payback period = 5000 2000 (1) ≅ 3 𝑦𝑒𝑎𝑟𝑠 (1) 8