Risk Mitigation and Corporate Compliance - The Value

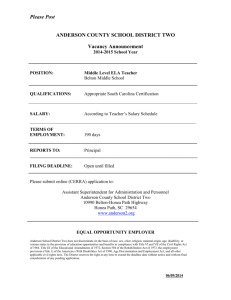

advertisement

Speaker Firms and Organization: Presented By: Joseph W. Koletar DPA, CFE FBI Senior Executive - Retired Anderson Terpening PLLC Peter C. Anderson Partner Lauer & Associates Steve Lauer Partner Thank you for logging into today’s event. Please note we are in standby mode. All Microphones will be muted until the event starts. We will be back with speaker instructions @ 11:55am. Any Questions? Please email: Info@knowledgecongress.org Group Registration Policy Please note ALL participants must be registered or they will not be able to access the event. If you have more than one person from your company attending, you must fill out the group registration form. We reserve the right to disconnect any unauthorized users from this event and to deny violators admission to future events. To obtain a group registration please send a note to info@knowledgecongress.org or call 646.202.9344. 1 May 12, 2011 If you experience any technical difficulties during today’s WebEx session, please contact our Technical Support @ 866-779-3239. You may ask a question at anytime throughout the presentation today via the chat window on the lower right hand side of your screen. Questions will be aggregated and addressed during the Q&A segment. Please note, this call is being recorded for playback purposes. If anyone was unable to log in to the online webcast and needs to download a copy of the PowerPoint presentation for today’s event, please send an email to: info@knowledgecongress.org. If you’re already logged in to the online webcast, we will post a link to download the files shortly. “If you are listening on a laptop, you may need to use headphones as some laptops speakers are not sufficiently amplified enough to hear the presentations. If you do not have headphones and cannot hear the webcast send an email to info@knowledgcongress.org and we will send you the dial in phone number.“ 2 May 12, 2011 About an hour or so after the event, you'll be sent a survey via email asking you for your feedback on your experience with this event today - it's designed to take less than two minutes to complete, and it helps us to understand how to wisely invest your time in future events. Your feedback is greatly appreciated. If you are applying for continuing education credit, completions of the surveys are mandatory as per your state boards and bars. 6 secret words (3 for each credit hour) will be give through out the presentation. We will ask you to fill these words into the survey as proof of your attendance. Please stay tuned for the secret word. Speakers, I will be giving out the secret words at randomly selected times. I may have to break into your presentation briefly to read the secret word. Pardon the interruption. 3 May 12, 2011 Brief Speaker Bios: Joseph W. Koletar Over twelve years' experience as an Executive Director, Principal, and Director in the Fraud and Investigations practices of Ernst & Young LLP and Deloitte & Touché LLP. During this time Dr. Koletar conducted and managed investigations in retail, manufacturing, media, hospitality, health care, energy, banking, financial services, insurance, transportation, and not-for-profits. Matters addressed included: executive defalcations, conflict of interest, revenue recognition, court-ordered monitoring of a business convicted of criminal tax violations, channel stuffing, sales commission schemes, payroll and disbursement schemes, Foreign Corrupt Practices Act, vendor integrity, grey market and product counterfeiting, anti-money laundering controls, protection of intellectual property, due diligence, fraud vulnerability assessments, compliance testing, and crisis management preparedness. Peter C. Anderson Pete has extensive experience in federal criminal law, having been a federal prosecutor in both Charlotte and Washington, D.C., as well as a defense attorney in various national law firms since 1996. Apart from his counseling and trial practice, he is an adjunct professor at the Charlotte School of Law, and teaches courses in both Trial Practice and White-Collar Crime. Pete also frequently writes and lectures on topics relating to federal business crimes, corporate compliance planning, trial advocacy, and sentencing issues. Pete was also selected by U.S. Senator Hagan (D-NC) as one of the three finalists whose names were sent to President Obama for consideration as the U.S. Attorney for the Western District of North Carolina. 4 May 12, 2011 Brief Speaker Bios: Steve Lauer As Principal of Lauer & Associates, Steven A. Lauer consults with law departments and law firms on the value of legal service. He assists them to better align and recalibrate the cost and value of legal service delivered to corporations and other business entities. Steve served as Corporate Counsel for Global Compliance Services in Charlotte, North Carolina, specializing in data protection and privacy for that hotline and compliance services company. Before that, he served for over two years as Director of Integrity Research for Integrity Interactive Corporation, in which capacity he conducted research, wrote white papers and otherwise worked with clients and potential clients of the company on issues related to corporate ethics and compliance programs. Those two positions culminated Steve’s approximately seven years in the compliance industry. ► For more information about the speakers, you can visit: http://knowledgecongress.org/event_2010_risk_mitigation.html 5 May 12, 2011 While we cannot eliminate all risk, we can do a much better job of mitigating it. Internal fraud risk alone is estimated to cost the average organization six percent of revenue each year, regardless of its type or industry. The irony is that we have many of the tools at our disposal to mitigate risk, but do not use them effectively. In this 2-hour, live webcast organized by The Knowledge Group, a panel of experts will discuss the most critical issues, which include: 6 May 12, 2011 - How we think about risk. - Who owns risk? - The risk mitigation controls we use and why they can fail. - A false sense of security. - Why good news may be worse than bad news. - We tend to protect against outside risk, while a greater threat may be inside. - How do we improve risk mitigation – strategies, tools, and techniques? - The consequences of failure. The presentation will also focus on one of these consequences, albeit a major one – compliance. Another highlight of this event is a discussion on the civil, administrative, and even criminal repercussions that can follow failure to mitigate risk, which includes financial, litigation, regulatory, and reputational damages. 7 May 12, 2011 Featured Speakers: SEGMENT 1: SEGMENT 2: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Peter C. Anderson Partner Anderson Terpening PLLC SEGMENT 3: Steve Lauer Principal Lauer & Associates 8 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Introduction Over twelve years' experience as an Executive Director, Principal, and Director in the Fraud and Investigations practices of Ernst & Young LLP and Deloitte & Touché LLP. During this time Dr. Koletar conducted and managed investigations in retail, manufacturing, media, hospitality, health care, energy, banking, financial services, insurance, transportation, and not-for-profits. Matters addressed included: executive defalcations, conflict of interest, revenue recognition, court-ordered monitoring of a business convicted of criminal tax violations, channel stuffing, sales commission schemes, payroll and disbursement schemes, Foreign Corrupt Practices Act, vendor integrity, grey market and product counterfeiting, anti-money laundering controls, protection of intellectual property, due diligence, fraud vulnerability assessments, compliance testing, and crisis management preparedness. 9 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Dr. Joseph W. Koletar – Author – “Rethinking Risk” How We Think About Risk • Good Thing? • Bad Thing? Risk In Our Daily Lives • Our Morning Routine • Risk Mitigation Becomes Invisible 10 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Dr. Joseph W. Koletar – Author – “Rethinking Risk” Who owns risk? • Board of Directors • Audit Committee • “C” suite executives • Middle management • Investors • Customers • Vendors 11 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Dr. Joseph W. Koletar – Author – “Rethinking Risk” Risk Mitigation Controls and Why They Fail • Performance Plans • Audit • Risk Department • General Counsel • A–B–C 12 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Dr. Joseph W. Koletar – Author – “Rethinking Risk” A False Sense of Security Good News Versus Bad News Outside Versus Inside Threats 13 May 12, 2011 SEGMENT 1: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Dr. Joseph W. Koletar – Author – “Rethinking Risk” Getting Better The Consequences of Failure BALANCE! 14 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Introduction Pete has extensive experience in federal criminal law, having been a federal prosecutor in both Charlotte and Washington, D.C., as well as a defense attorney in various national law firms since 1996. Apart from his counseling and trial practice, he is an adjunct professor at the Charlotte School of Law, and teaches courses in both Trial Practice and White-Collar Crime. Pete also frequently writes and lectures on topics relating to federal business crimes, corporate compliance planning, trial advocacy, and sentencing issues. Pete was also selected by U.S. Senator Hagan (D-NC) as one of the three finalists whose names were sent to President Obama for consideration as the U.S. Attorney for the Western District of North Carolina. 15 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC One Former Prosecutor’s Viewpoint The Knowledge Group May 12, 2011 Peter Crane Anderson Anderson Terpening PLLC 16 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Unique Perspective “Recovering” Prosecutor Goals in Private Practice: • Help Clients Sail Through the Prosecutorial Storms • “Teach Lessons Without Slamming Jail Cell Doors” • Redefine Business Crimes Defense & Litigation = Risk Mgmt. Proactive Compliance Reduce Risks Reactive Defense Minimize Harm 17 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Main Goals of Presentation Recent Enforcement Trends in Business Crimes Share Prosecutor’s Mindset & Perspective • A Peak Inside Opponents “Playbook” • Review Relevant Policies/Guidance Practical Suggestions for “Effective” Compliance • Reducing Risks • Adding Value 18 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Telling Statistics @ Enforcement New & Expanding Enforcement Priorities Regardless of Administration/Party Politics • President Bush - Corporate Fraud Task Force (2002) • 250 corporate fraud convictions within first year President Obama - Financial Fraud Enforcement Task Force (Exec. Order – 2009) Multi-Agency Involvement Massive Resources 19 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Typical Assumption . . . 20 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC What Is Basis for that Assumption? We Have Never Been Indicted Before We are “Good People” – Not “Criminals.” Pure Hope (?) – We Have Enough “Real” Problems Auditing/Monitoring Maintain a Healthy Skepticism Remain Open to Possibility of Criminal Conduct !! 21 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC The Three Certainties in Life . . . Death Taxes Corporate Crises 22 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Timing of Crisis Management Efforts Before During After 23 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Focus of Effective Compliance PREVENTION RESPONSE DETECTION 24 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC When a Crisis Erupts . . . Accusers Always Have 20/20 Hindsight Corporate Leaders Must Be Prepared to Answer (& Document) the Following Questions: • What did you do to prevent/detect? • How could you NOT have known? 25 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Convergence to Two Major Risks – Enforcement Leverage Low Legal Threshold for Organizational Liability Broad Prosecutorial Discretion 26 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Low Legal Threshold for Culpability Broad Criminal Liability for Organizations • Anytime an employee commits a crime within the apparent scope of employment • Even if the employee acted directly contrary to company policy or instructions 27 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Broad Prosecutorial Discretion What conduct should be prosecuted? ----- Higher Standard Zone of Discretion ----- Low Threshold What conduct can be prosecuted? 28 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Tremendous Prosecutorial Discretion: Potential Targets: Individuals & Corporations Potential Charges: Wide Variety of Substantive & Process Crimes 29 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC In View of Two Dangers Goal: Understand & Influence Prosecutorial Discretion Demonstrate “Good Corporate Citizenship” Avoid Being Perceived by Government As a “Bad Actor” Government “Perception” is Reality 30 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC How Do You Establish a Compliance Program? Review legal requirements Identify areas of focus Ensure program meets Guidelines requirements Upgrade program where necessary Tailor-Fit Program to Unique Operations 31 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC 7 Criteria for “Effective” Corporate Compliance Plans 1. Establishing compliance standards and procedures that are reasonably capable of reducing the prospect of criminal conduct (i.e. written company policy statements and policies approved by senior management or board); 2. Assigning overall oversight responsibility to specific individuals within high-level positions (i.e. centralized compliance activities and a compliance officer with authority to monitor); 32 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC 7 Criteria for “Effective” Corporate Compliance Plans 3. Exercising due care not to delegate responsibility to individuals who are predisposed to illegal activities (accomplished with a careful and welldocumented screening process for key employees); 4. Effectively communicating the program's standards and procedures to all employees (i.e. adequate employee training); 5. Taking reasonable steps to achieve compliance with the standards (i.e. monitoring, auditing, establishing best practices benchmarks, etc.); 33 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC 7 Criteria for “Effective” Corporate Compliance Plans 6. Consistently enforcing the standards through appropriate disciplinary mechanisms (i.e. disincentives policy, range of disciplinary measures including termination, etc.); 7. Responding appropriately to an offense and taking all reasonable steps to prevent similar offenses, including any necessary program modifications (i.e. authorizing or conducting internal investigations) 34 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Federal Sentencing Guidelines - Criteria for Effective Programs Size of the organization • Nature of the business • Highly regulated activities require greater effort Prior compliance history • Formal program for larger companies Previous problem areas should be addressed Industry standards • Must meet or exceed industry standards 35 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC “Good Faith” Oversight Confirm Procedures Are In Place & Used: • Reporting Misconduct or Violations; • Documenting Complaints; • Investigating Complaints / Responding to “Red Flags” • Upper Management Reporting & Response • Enforcing Program • Complying with Stated Policies • Improving Training (i.e. Self-Correcting) 36 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Overview of Top Priorities for Board Oversight of Crisis Management Maintain Open Lines of Communication • Internally - Within Corporation • Employees / Vendors / Customers = “Helplines” Between Chief Compliance Officer & Board Affirmative Reporting & Documentation 37 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC A Peak Inside the Government’s Playbook Viewing a Case From the Other Side’s Perspective – “Thinking Like a Prosecutor” 38 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Sources of Insight/Guidance “Principles of Federal Prosecution” (General) “Factors to Be Considered in Charging Corporations” Statutory Sentencing Factors (18 U.S.C. 3553) 39 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC “Principles of Federal Prosecution of Business Organizations” (Sec. 9-28.300) General Factors To Consider in Charging: Nature & Seriousness of Offense Pervasiveness of Wrongdoing w/in Corporation Corporation’s History of Wrongdoing (Crim/Civ/Reg) Corporation’s Timely & Voluntary Disclosure Existence & Adequacy of Corp’s Compliance Program Corporation’s Remedial Actions Collateral Consequences Adequacy of Prosecution of Individuals or Civil Actions 40 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Focus on Compliance Programs Factors in Evaluating a Compliance Program (among others): Corporate governance mechanisms to detect and prevent misconduct, such as director’s oversight of compliance. Staff sufficient to audit, document, analyze and use the corporation’s compliance efforts. Employee’s knowledge of – and “buy-in” regarding the compliance program. 41 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Goal: Understand & Influence Prosecutorial Discretion What is Root Cause of Problem ? – A “Bad Apple” (Employee) – A “Bad Orchard” (Organization / Culture) 42 May 12, 2011 Goal: Understand &Influence Prosecutorial Discretion 43 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC DOJ’s “Filip Memo” (8/28/08) Two Criteria Unique to Board Oversight: Do the corporate directors exercise independent review over proposed corporate actions, rather than unquestionably ratifying recommendations? Have the directors established an information and reporting system in the organization that is reasonably designed to provide management and directors with timely and accurate information sufficient to allow them to reach an informed decision regarding the organizations compliance with the law? 44 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Earning Your “Good Corporate Citizenship” Merit Badge Does your corporation have compliance plans / ethics policies? Demonstrated commitment from management? Who is in charge of compliance? Centralized? CCO? Do you do sufficient background checks? Training? Anonymous Hotline? 45 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Earning Your “Good Corporate Citizenship” Merit Badge Implementation? Benchmarking? (objective monitoring /audit/enforce) Documentation? Plans to Respond to Incidents? Continual Improvements? 46 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Pyramid of Possibilities re: Compliance Programs “No Hope” 10% Shades of Gray 80% Need a Tie-Breaker “No Need” 10% 47 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Reasons for Setting Up A Compliance Program? Fiduciary Duties (as noted) Influence Prosecutor’s Discretion • Argument for not bringing criminal charges (both company & individuals) Proof of “Good Corporate Citizenship” Merit Badge • “If the Prosecutor Won’t Listen . . . Perhaps a Jury Will” Improve corporate image with public, employees, and community Increase value of company Provide for efficient management of compliance costs Reduce penalties or fines 48 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Why Does Compliance Really Matter? Penalty Reductions? • (Only Part of the Story) Much More Significant Broader Applications – • “Ethical Barometer” or “Surrogate” • Better Management 49 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Key Decision Points – Equal Relevance Investigate ? Indict? Liability? Convict ? Degree of Punishment? (Prosecutor) (Jury) (Judge) What is Organizational Culture? “Effective” Compliance? 50 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Measuring “Organizational Culture?” What an Organization SAYS? • Written Materials? Code of Conduct Plan & Procedures What an Organization actually DOES? • Measures/Monitors/Records • Invests • Incentives – Punishments & Rewards 51 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC A Former Prosecutor’s Twist on Anonymous Hotlines Resistance & Perspectives Justifications/Rationale: You want to learn @ “bad news” If they don’t call you, they will call someone. Discredit whistle-blower who never called Inconsistent with “bad orchard” status Willingness to Listen & Respond Be Prepared to Document 52 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC A Former Prosecutor’s Twist on Anonymous Hotlines Don’t Assume Low # of Calls is a Good Thing • No Calls = No Problems. • Could Mean: EE’s Are Potentially Unaware Concerns @ Retaliation/Anonymity No Real “Buy-In” By Mgmt. Don’t Assume Waste of Time & Money !! • Value of Such Tools is in What It Conveys @ Commitment • NOT merely the Information Conveyed / Received 53 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC A Former Prosecutor’s Twist on Background Checks Don’t Assume “No Need” . . . Based on: • Nice Appearance • Very Professional Demeanor • Great Pedigree • Strong References Myth: Waste of Money Due to Low % of “Hits” • The Real Value = The Checking. Willingness to Look & Document. What Does that Say About the Corporate Culture. 54 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Establishing a Proactive Attitude About Compliance Vigorous and visible management support Compliance made a part of doing business Consistent communication and diligent implementation Targeted at high risk areas Empowered employees supported by standards and training 55 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC On-Going Debate – ROI for Effective Programs Traditional View: • Cost Center (vs. Revenue Center) • Limited Value Added On-going Studies/Research Recent Announcements – Public Filings • “Costs” of Enforcement/Defense/Fines • 25% decline 56 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC On-Going Debate – ROI for Effective Programs Recommendations to DOJ: • Go Beyond Mere Guidance & Policies • Document & Report Sanitized “Declinations” Based Upon Effective Compliance/Ethics Programs • “The Carrot” 57 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC “Near Irreparable” Harms From Criminal Investigation/Conviction Mandatory Jail Time for Executives Massive Criminal Fines Corporate Probation & Monitoring ($$) Low Employee Morale Adverse Impacts on Shareholders & Customers Horrible Publicity Devaluation of Company Degraded Reputation Increased Regulatory Scrutiny in Future 58 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC On-Going Debate – ROI for Effective Programs Reflections from Prosecutorial Days: • “Peek Behind the Curtain” – Near Miss/$$ Sustainability Strengthens the brand, and customer loyalty Enhances financial performance, and shareholder value 59 May 12, 2011 SEGMENT 2: Peter C. Anderson Partner Anderson Terpening PLLC Any Questions? Peter Anderson Anderson Terpening PLLC Office:704.372.7370 Cell: 704.756.8800 pa@HouseofDefense.com www.houseofdefense.com 60 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Introduction As Principal of Lauer & Associates, Steven A. Lauer consults with law departments and law firms on the value of legal service. He assists them to better align and recalibrate the cost and value of legal service delivered to corporations and other business entities. Steve served as Corporate Counsel for Global Compliance Services in Charlotte, North Carolina, specializing in data protection and privacy for that hotline and compliance services company. Before that, he served for over two years as Director of Integrity Research for Integrity Interactive Corporation, in which capacity he conducted research, wrote white papers and otherwise worked with clients and potential clients of the company on issues related to corporate ethics and compliance programs. Those two positions culminated Steve’s approximately seven years in the compliance industry. 61 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates The Business Judgment Rule vs. The Sentencing Guidelines Uneasy Bedfellows or Intractable Foes? 62 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates The Business Judgment Rule Directors have a duty of attention or care in connection with their oversight of corporate management. Directors represent and owe responsibility directly to shareholders. Directors should understand generally the risks inherent in the business or unique to the company (including fraud-related risk). The business judgment rule is a judicially created protection for directors of corporations, insulating from review decisions by directors made in good faith in the course of managing the company. 63 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Recent Judicial Decisions In re Caremark International (1996): directors sued for breach of duty of attention on account of company’s payment of significant fines due to violation of Medicare/Medicaid reimbursement statutes. “the Board was to some extent unaware of the activities that led to liability” though the company had a functioning corporate information system designed to detect criminal conduct. The court cited approvingly the Sentencing Guidelines for Organizational Defendants 64 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates The Sentencing Guidelines Sentencing Guidelines for Organizational Defendants issued in 1991 and revised in 2004. One element of an “effective” compliance and ethics program is a hotline or similar means by which individuals can report actual or suspected fraud or criminal activity. Guidelines indicate that the board “shall be knowledgeable about the content and operation of the compliance and ethics program and shall exercise reasonable oversight” of that program. 65 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Director Ignorance In Caremark, because the directors claimed that they were unaware of the criminal activity and had no reason so suspect its occurrence, the court applied the business judgment rule and found them not liable. Under the Guidelines, directors should receive reports of actual compliance history whether or not they suspect any wrongdoing. 66 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Sarbanes-Oxley The Sarbanes-Oxley Act includes a directive that directors of public corporations “establish procedures for … the receipt … and treatment of complaints … regarding accounting, internal accounting controls, or auditing matters”. This establishes a channel by which the directors should receive reports of illegal conduct more quickly than previously. This parallels the requirement in the Sentencing Guidelines for a mechanism for reporting actual or suspected criminal activity 67 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Prosecutors’ views United States Department of Justice expects corporate directors will “establish … an information and reporting system … reasonably designed to provide management and directors with timely and accurate information sufficient to allow them to reach an informed decision regarding the organization’s compliance with the law.” 68 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Steve A. Lauer Expert in role of lawyers in compliance Former in-house lawyer (privacy/data protection; environmental law; lit. mgt.) Consultant to law departments/firms on value Speaker Author of The Value-Able Law Department and Managing Your Relationship with External Counsel and dozens of articles. 69 May 12, 2011 SEGMENT 3: Steve Lauer Principal Lauer & Associates Contact Information Steve A. Lauer Lauer & Associates 973-207-3741 slauer@carolina.rr.com www.thevalue-ablelawyer.com 70 May 12, 2011 Q&A: SEGMENT 1: SEGMENT 2: Joseph W. Koletar, DPA, CFE FBI Senior Executive - Retired Peter C. Anderson Partner Anderson Terpening PLLC SEGMENT 3: Steve Lauer Principal Lauer & Associates ► You may ask a question at anytime throughout the presentation today. Simply click on the question mark icon located on the floating tool bar on the bottom right side of your screen. Type your question in the box that appears and click send. ► Questions will be answered in the order they are received. 71 May 12, 2011 Notes: 72 May 12, 2011 ABOUT THE KNOWLEDGE CONGRESS: The Knowledge Group, LLC is an organization that produces live webcasts which examine regulatory changes and their impacts across a variety of industries. “We bring together the world's leading authorities and industry participants through informative two-hour webcasts to study the impact of changing regulations.” If you would like to be informed of other upcoming events, please click here. Disclaimer: The Knowledge Group, LLC is producing this event for information purposes only. We do not intend to provide or offer business advice. The contents of this event are based upon the opinions of our speakers. The Knowledge Congress does not warrant their accuracy and completeness. The statements made by them are based on their independent opinions and does not necessarily reflect that of The Knowledge Congress' views. In no event shall The Knowledge Congress be liable to any person or business entity for any special, direct, indirect, punitive, incidental or consequential damages as a result of any information gathered from this webcast. 73 May 12, 2011