Quiz 2-157 1. O'Reilly Enterprises manufactures digital video

advertisement

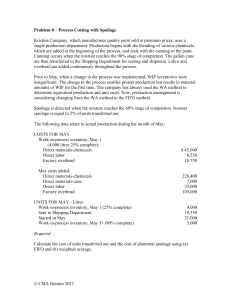

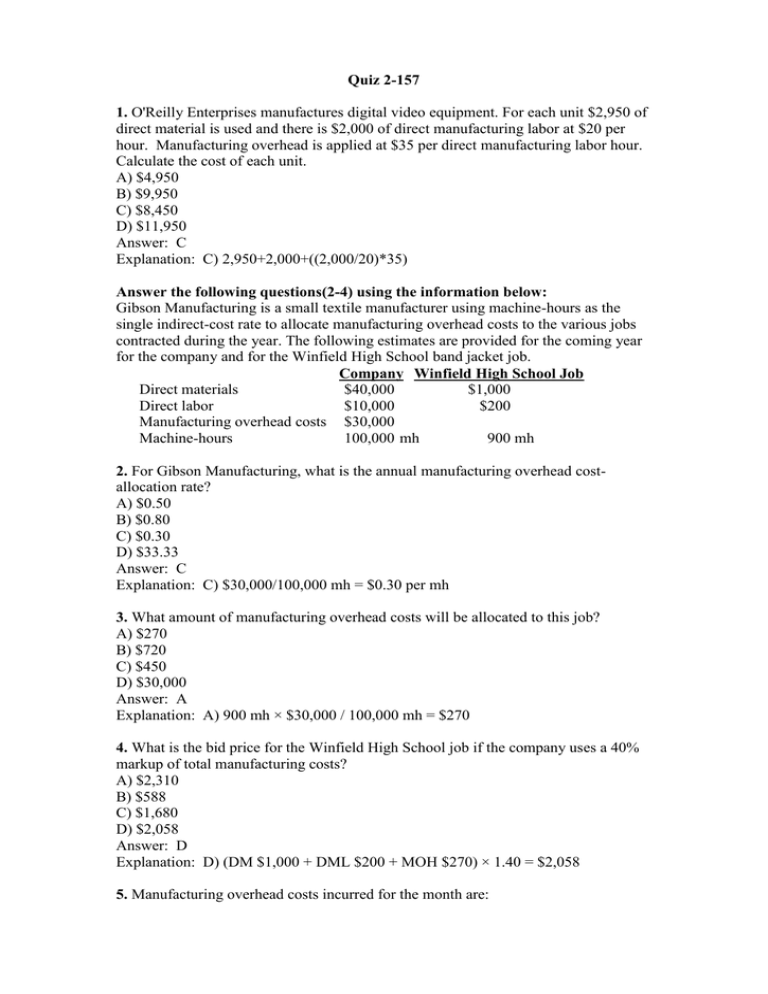

Quiz 2-157 1. O'Reilly Enterprises manufactures digital video equipment. For each unit $2,950 of direct material is used and there is $2,000 of direct manufacturing labor at $20 per hour. Manufacturing overhead is applied at $35 per direct manufacturing labor hour. Calculate the cost of each unit. A) $4,950 B) $9,950 C) $8,450 D) $11,950 Answer: C Explanation: C) 2,950+2,000+((2,000/20)*35) Answer the following questions(2-4) using the information below: Gibson Manufacturing is a small textile manufacturer using machine-hours as the single indirect-cost rate to allocate manufacturing overhead costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Winfield High School band jacket job. Company Winfield High School Job Direct materials $40,000 $1,000 Direct labor $10,000 $200 Manufacturing overhead costs $30,000 Machine-hours 100,000 mh 900 mh 2. For Gibson Manufacturing, what is the annual manufacturing overhead costallocation rate? A) $0.50 B) $0.80 C) $0.30 D) $33.33 Answer: C Explanation: C) $30,000/100,000 mh = $0.30 per mh 3. What amount of manufacturing overhead costs will be allocated to this job? A) $270 B) $720 C) $450 D) $30,000 Answer: A Explanation: A) 900 mh × $30,000 / 100,000 mh = $270 4. What is the bid price for the Winfield High School job if the company uses a 40% markup of total manufacturing costs? A) $2,310 B) $588 C) $1,680 D) $2,058 Answer: D Explanation: D) (DM $1,000 + DML $200 + MOH $270) × 1.40 = $2,058 5. Manufacturing overhead costs incurred for the month are: Utilities $30,000 Depreciation on equipment $25,000 Repairs $20,000 Which is the correct journal entry assuming utilities and repairs were on account? A) Manufacturing Overhead Control 75,000 Accounts Payable Control 50,000 Accumulated Depreciation Control 25,000 B) Manufacturing Overhead Control 75,000 Accounts Payable Control 75,000 C) Manufacturing Overhead Control 75,000 Accumulated Depreciation Control 75,000 D) Accumulated Depreciation Control 25,000 Accounts Payable Control 50,000 Manufacturing Overhead Control 75,000 Answer: A Answer the following questions(6-7) using the information below: Roosevelt Cabinetry, Inc., manufactures standard sized modular cabinet units for kitchens and other applications within the home. Its costing system utilizes two cost categories, direct materials and conversion costs. Each product must pass through the rough cut department and the finish department. Direct materials are added at the beginning of production. Conversion costs are allocated evenly throughout production. Data for Finish Department for March 2012 are: Work in process, beginning inventory, 25% converted 1,000 units Units started during February 1,400 units Work in process, ending inventory 300 units Costs for Finish department for March 2012 are: Work in process, beginning inventory: Direct materials $300,000 Conversion costs $200,000 Direct materials costs added during February $420,000 Conversion costs added during February $1,600,000 6. What is the unit cost per equivalent unit of the beginning inventory in the Finishing Department? A) $800.00 B) $300.00 C) $1,100.00 D) $500.00 Answer: C Explanation: C) Direct materials per unit ($300,000/1,000 units) $ 300 Conversion costs per unit ($200,000/(1,000 × 0.25) units) 800 Total costs per unit $ 1,100 7. How many units were completed and transferred out of the Finishing Department during March? A) 1,000 units B) 1,400 units C) 2,100 units D) Unknown Answer: C Answer the following questions(8-10) using the information below: Triboro Computer Systems, Inc., manufactures printer circuit cards. All direct materials are added at the inception of the production process. During January, the accounting department noted that there was no beginning inventory. Direct materials purchases totaled $200,000 during the month. Work-in-process records revealed that 8,000 card units were started in January, 4,000 card units were complete, and 3,000 card units were spoiled as expected. Ending work-in-process card units are complete in respect to direct materials costs. Spoilage is not detected until the process is complete. 8. What are the respective direct material costs per equivalent unit, assuming spoiled units are recognized or ignored? A) $20.00; $35.00 B) $25.00; $40.00 C) $30.00; $45.00 D) $35.00; $50.00 Answer: B Explanation: B) Calculation for Recognized Problem # Ignored Cost to account for: $200,000 $200,000 Divided by equivalent units 8,000 5,000 Cost per equivalent unit $ 25.00 (8) $ 40.00 Assigned to: Good units completed (4,000 × $25; $40) $ 100,000 $ 160,000 Normal spoilage (3,000× $25) 75,000 0 Costs transferred out 175,000 WIP ending inventory (1,000 × $25; $40) 25,000 Cost accounted for: $200,000 (9) (10) 160,000 40,000 $200,000 9. What is the cost transferred out assuming spoilage units are ignored? A) $175,000 B) $160,000 C) $100,000 D) $155,000 Answer: B 10. What are the amounts allocated to the work-in-process ending inventory assuming spoilage units are recognized and ignored, respectively? A) $40,000; $49,000 B) $60,000; $68,500 C) $25,000; $40,000 D) $75,000; $80,000 Answer: C